Visa begins supporting stablecoins on four blockchains!

Polymarket reports it aims to reopen in the US in November!

OpenAI restructures as a public interest corporation, with Microsoft acquiring a 27% stake!

ARK Invest purchases an additional $30.9 million in Jack Dorsey’s Blockchain-backed stock!

The first US-based Solana staking ETF begins trading today, sending new ripples through the altcoin market!

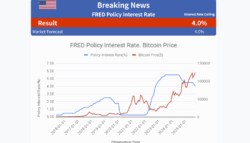

Let’s analyze the news on the global economy and cryptocurrencies and consider economic trends together! On Thursday, October 29th, we’ll be discussing today’s cryptocurrency news and on-chain market conditions.

This program brings you the latest news to help you with your asset building. Now, let’s take a look at 24-hour data headlines from the cryptocurrency market.

First, we’ll be highlighting the news that Visa will begin supporting stablecoins on four major blockchains. This marks a new step for the payment giant in the cryptocurrency space. Specifically, stablecoin payments and remittance services will become possible on popular blockchains such as Ethereum, Polygon, Solana, and Avalanche.

This is due to the growing demand for stablecoins, which have stable value, as the global digital payments market expands. Visa has previously focused on credit and debit cards, but by integrating them with cryptocurrencies, it hopes to capture new users and business opportunities.

While major financial institutions have previously focused on blockchain technology and cryptocurrencies and entered the market, the fact that a company with such a global payment network as Visa is fully committed to supporting stablecoins will likely boost trust in the market as a whole. Some experts believe this will further accelerate the efficiency of business-to-business remittances and cross-border payments.

Next, Polymarket, a decentralized prediction market platform, is reportedly aiming to reopen in the US in November. Polymarket previously withdrew from the US market due to regulatory issues, but this relaunch signals a resumption of activities in the US market and strengthened regulatory compliance.

This reflects the gradual improvement in the US regulatory environment and strong demand from market participants. Prediction markets are also attracting attention as financial products, and their revival is attracting expectations and attention from both inside and outside the industry.

Next, we’ll discuss OpenAI’s restructuring. OpenAI has changed its organizational structure to a public benefit corporation, and in the process, Microsoft acquired a 27% stake. This represents a deepening of the company’s AI technology development and commercialization strategy, and is important in terms of strengthening collaboration between major IT companies and AI startups.

Microsoft’s aim is to “strengthen its competitiveness in the AI field and promote long-term technological innovation,” and this investment is having a major impact on the industry as a whole. At the same time, OpenAI faces the difficult task of balancing public benefit and commercial interests.

Furthermore, investment fund ARK Invest has made moves. Led by Cathie Wood, ARK Invest has increased its stake in Block, a company affiliated with Jack Dorsey, by approximately $30.9 million. Block is known for its mobile payments and Bitcoin-related businesses, and this large investment is seen as a sign of ARK’s bullish stance on virtual currencies and fintech.

Finally, the first Solana staking ETF in the United States began trading today. This ETF allows Solana holders to receive staking rewards, drawing attention for its easier and safer method of earning yield.

This development is likely to increase capital inflow pressure across the altcoin market as a whole. Some market participants have commented that “expectations are growing for the creation of similar ETFs beyond Solana.”

Let’s now summarize the psychological and economic impact of these five pieces of news.

First, the expansion of cryptocurrency-related businesses by major global players such as Visa and Microsoft will lead to increased confidence in the market as a whole. This will have a positive impact on investor sentiment, encouraging new entrants and increased activity among existing users.

Second, the regulatory environment and diversification of financial products, such as the reopening of Polymarket and the Solana ETF, are expanding the market’s participant base. This will likely increase capital inflow pressure, particularly from both institutional and retail investors, potentially leading to expectations for medium- to long-term market growth.

Thirdly, on the other hand, deepening collaboration with cutting-edge technology and fintech sectors, such as OpenAI’s restructuring and ARK Invest’s large investment, suggests the creation of new innovations and intensifying competition. This also means an increased risk of market volatility due to an acceleration of the technological innovation cycle, requiring careful risk management.

That concludes today’s news highlights. Our channel provides in-depth, specialized features focusing on valuable news in the cryptocurrency world. If you find this channel valuable, we would appreciate it if you would share, follow, and turn on notifications.

See you tomorrow.