Trump and Xi Jinping hold direct talks in South Korea to resolve the tariff issue that caused this month’s cryptocurrency crash!

The FOMC cut interest rates by 25 basis points as expected, but some say the market has already factored this in.

The Fed’s rate cut is a step forward, but there are concerns that further macroeconomic risks lurk in the background.

Are banks undervaluing stablecoins? Coinbase strongly refutes this ignorance.

The European Central Bank is moving forward with plans to introduce a CBDC (central bank digital currency) by 2029.

Let’s analyze the news on the global economy and cryptocurrencies and consider economic trends together!

On Thursday, October 30th, we will discuss today’s cryptocurrency news and on-chain market conditions.

This program brings you the latest news to help you with your asset building.

Now, let’s take a look at 24-hour data headlines from the cryptocurrency market.

Let’s start with the news that former President Trump and Chinese President Xi Jinping met in South Korea to discuss the tariff issue, which contributed to this month’s sharp decline in the cryptocurrency market.

This development is particularly noteworthy, as the ongoing trade friction between the US and China since the beginning of this month has had a major impact on the cryptocurrency market, particularly. Concerns about higher tariffs and trade restrictions have dampened investor sentiment, causing many digital assets to plummet.

Now that Trump and Xi have met face-to-face in South Korea, hopes are high that tensions will ease. Past US-China summits have seen markets react sensitively, with prices recovering within a few weeks, so a similar effect is expected this time around.

Some market participants have said that if concrete measures to eliminate or ease tariffs are announced at this meeting, the cryptocurrency market could bottom out in the short term. On the other hand, others are cautious, noting that uncertainty will remain if fundamental trade structural issues remain unresolved.

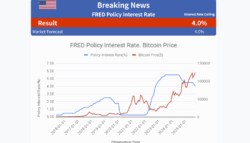

Next, we’ll discuss the analysis that “The Federal Open Market Committee (FOMC) implemented a 25 basis point interest rate cut, but the market had already factored it in.”

The FOMC lowered the policy rate by 0.25% on October 29. This rate cut was expected, and market participants had prepared for it, so it didn’t come as a major surprise.

However, the background to this rate cut is complex. Many macroeconomic challenges remain, including concerns about a global economic slowdown and instability in the banking sector. As a result, some analysts have pointed out that “while this appears to be a moderate rate cut, additional risks lurk behind the scenes.”

This move has also had some impact on the dollar/yen exchange rate and stock markets, but the reaction has been limited. This indicates that the market as a whole will continue to closely monitor additional measures and economic indicators from the Fed.

Next, we’ll discuss the topic of “Hidden macroeconomic risks emerge despite the Fed rate cut.”

The Fed’s 25 basis point rate cut was welcomed as a sign of monetary easing, but there are several challenges behind the scenes. One is that inflationary pressures are still some way from subsiding completely. Another is that trust in the banking system as a whole is still only half-way restored.

Given these circumstances, market participants and experts believe that maintaining the status quo is insufficient and that new monetary policy and regulatory responses will be necessary. Many also express caution, noting that these complex factors have left the cryptocurrency market highly volatile.

And now, the news has hit us: “Banking Industry Concerns About Stablecoins: Are They Ignoring Reality? Coinbase Strikes Back.”

Many bankers are concerned about stablecoins’ credit risk and regulatory uncertainty. However, Coinbase has responded to these criticisms, stating that “stablecoins ensure transparency and security, and play an important role in the modern financial system.”

More than just a technical debate, this conflict highlights the gap in values and regulatory policies between financial innovation and established financial institutions. Some experts believe that this dialogue will be key to the future widespread adoption of digital assets.

Finally, I would like to discuss the report that the European Central Bank (ECB) is steadily moving forward with plans to introduce a CBDC (central bank digital currency) by 2029.

The ECB is steadily progressing with its roadmap for issuing a digital euro. While this CBDC plan is expected to bring many benefits within Europe, such as financial inclusion, payment efficiency, and improved security, privacy protection and technical issues are also being debated.

Some inside and outside Europe have commented that the clear deadline of 2029 provides direction to the market and reduces uncertainty. However, market participants remain cautious, citing the need for extensive testing and adjustment before implementation.

All five of these news stories will have a major impact on both the global economy and the cryptocurrency market, and will likely remain a hot topic for the next few years.

There are three important signals surrounding this change.

First, there are hopes that the resumption of political dialogue will reduce geopolitical risks and improve investor sentiment.

Second, central bank policy adjustments and plans to introduce new financial technology will increase pressure to adapt to changes in the financial environment.

Third, lively discussions and competition have begun between established financial institutions and emerging digital asset companies regarding values and regulatory responses.

It can be said that these factors are intricately intertwined as each market participant paints a picture of the future.

That’s the main content of today’s news. This channel provides in-depth, specialized features focusing on valuable news in the cryptocurrency world.

If you find this channel valuable, please share, follow, and turn on notifications.

See you tomorrow.