Crypto Markets React to Trump’s Renewed Tariff Threats

The cryptocurrency market experienced a significant downturn following former President Donald Trump’s announcement of potential new tariffs on Chinese goods. Bitcoin (BTC), Ethereum (ETH), and Solana (SOL), among other cryptocurrencies, saw sharp declines, leading to a total market capitalization loss of $509 million. This sudden drop highlights the crypto market’s vulnerability to external economic and political factors, reinforcing its interconnectedness with traditional financial markets.

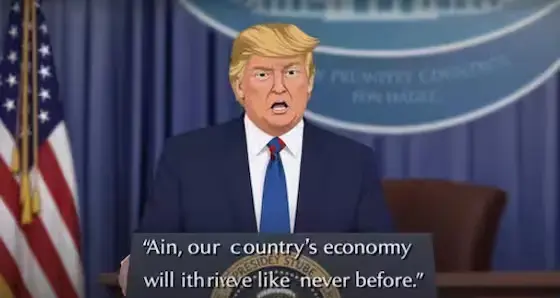

Trump’s Trade War Rhetoric Reignites Market Uncertainty

Trump’s statement, reminiscent of his previous trade war tactics, injected a fresh wave of uncertainty into global markets. He suggested the possibility of imposing a 10% tariff on all remaining Chinese imports, a move that could escalate trade tensions and potentially trigger a broader economic slowdown. This announcement rattled investor confidence, prompting a sell-off across various asset classes, including cryptocurrencies. The crypto market, known for its volatility, reacted swiftly to the news, with major cryptocurrencies experiencing substantial price drops.

Bitcoin, Ethereum, and Solana Lead the Decline

Bitcoin, the largest cryptocurrency by market capitalization, led the decline, shedding a significant percentage of its value. Ethereum, the second-largest cryptocurrency, also experienced a notable drop. Solana, a popular altcoin, followed suit, mirroring the downward trend of the broader market. These price drops erased recent gains and underscored the market’s sensitivity to macroeconomic headwinds. While the crypto market has shown resilience in the past, events like these demonstrate its susceptibility to external shocks and the influence of global economic sentiment.

The Interconnectedness of Crypto and Traditional Markets

The crypto market’s reaction to Trump’s tariff threat underscores the growing interconnectedness between digital assets and traditional financial markets. While often touted as a hedge against traditional market volatility, cryptocurrencies have increasingly shown correlation with stocks and other assets. This suggests that factors impacting traditional markets, such as trade disputes, geopolitical tensions, and macroeconomic policy changes, can also significantly influence the crypto market. This interconnectedness challenges the narrative of cryptocurrencies as completely independent and insulated from broader economic forces.

Market Volatility and Investor Sentiment

The recent market downturn serves as a reminder of the inherent volatility within the cryptocurrency space. While offering the potential for high returns, cryptocurrencies also carry significant risk. Investor sentiment plays a crucial role in driving market movements, and news events like Trump’s tariff announcement can quickly shift sentiment from bullish to bearish. This volatility underscores the importance of careful risk management and a thorough understanding of market dynamics for cryptocurrency investors. As the crypto market continues to mature and integrate with the broader financial landscape, its sensitivity to external factors is likely to persist. Investors should remain vigilant and prepared for potential price fluctuations driven by global events and policy changes.