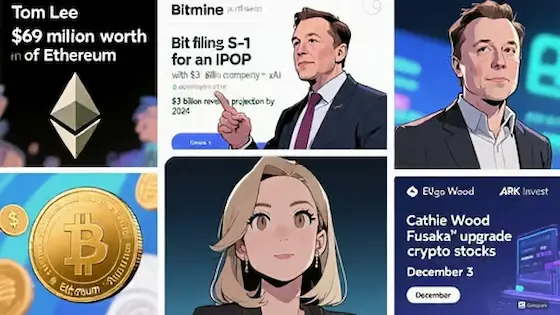

Bitmine, led by Tom Lee, purchased an additional $69 million worth of Ethereum, bringing its total holdings to an astounding $8.66 billion.

Additionally, BitGo has filed its S-1 for an IPO, revealing a revenue projection of $3 billion by 2024.

Elon Musk’s new AI company, xAI, is reportedly aiming to raise $10 billion.

Ethereum’s major upgrade, “Fusaka,” is scheduled for December 3rd, and is likely to have a major impact on the entire industry.

Finally, Cathie Wood’s ARK Invest has also been making waves by actively purchasing newly listed cryptocurrency-related stocks.

Let’s analyze the news about the global economy and cryptocurrencies and consider economic trends together!

On Saturday, September 20th, we will discuss today’s cryptocurrency news and on-chain market conditions.

This program brings you the latest news to help you with your asset building efforts.

Let’s start by looking at 24-hour data headlines from the cryptocurrency market.

Let’s start with Bitmine’s massive Ethereum purchase. “Tom Lee’s Bitmine Buys Another $69M ETH, Holds Massive $8.66B Stack.” This isn’t just a purchase. Bitmine purchased an additional $69 million worth of ETH, swelling its total holdings to $8.66 billion.

This move sends a strong message to the market. Tom Lee and Bitmine have long been influential figures in the cryptocurrency industry, and this huge investment reflects confidence in Ethereum and expectations for its future.

The background to this is the expansion of the Ethereum ecosystem as a whole, including the transition to Ethereum 2.0 and the growth of DeFi (decentralized finance). In the past, large purchases by large investors have often been a sign of rising prices, so market participants are paying close attention and expecting it to be a big hit.

While some experts are cautious, pointing out that maintaining a position of this magnitude entails risks, many view this as a positive development.

Next, noteworthy is BitGo’s IPO preparations. BitGo, one of the largest cryptocurrency custodians in the United States, has filed its S-1 form with the Securities and Exchange Commission. The document predicts revenue of $3 billion in 2025.

BitGo provides cryptocurrency storage services to institutional investors, and this IPO once again demonstrates the company’s growth rate and scale. This IPO could be an important milestone for the cryptocurrency industry.

Market participants have welcomed the listing of a previously privately held company, saying it will increase transparency and credibility across the entire market. This move will also likely encourage further institutional investor participation.

Next, we’ll look at topics related to Elon Musk. Musk’s xAI is reportedly seeking $10B in a new funding round.

This round likely extends beyond AI, potentially targeting the development of new services linked to blockchain and other digital technologies. The market is excited, with many saying, “We’re excited to see what innovative technologies and projects this massive funding will lead to.”

Ethereum itself is also undergoing a major transformation. The Fusaka Upgrade, scheduled for December 3rd, will improve user experience in many ways, including improving network performance and reducing fees. The success of this upgrade is expected to further invigorate the entire Ethereum ecosystem.

Historically, major upgrades have been followed by price fluctuations and increased usage, so market participants are paying close attention to this date.

Finally, let’s touch on ARK Invest’s Cathie Wood’s active investment in IPOs. “Cathie Wood Is Buying Up This Newly Public Crypto Stock. Should You?” ARK Invest has recently purchased a large amount of cryptocurrency-related stocks listed on Bullish (BLSH), a global digital asset platform. This move is in line with her investment philosophy of “early investment in innovative technology.”

Market sentiment:

– First, ARK Invest’s increased purchases demonstrate confidence in the stocks and expectations for their future value.

– Second, many retail investors are likely to follow suit and increase their purchase orders.

– Third, there is also the risk of short-term price fluctuations, so careful decision-making is required.

The actions of these large investors have an impact on the market as a whole, so we will continue to keep a close eye on them.

That’s all for today’s news highlights. Our channel provides in-depth, specialized features focusing on valuable news in the cryptocurrency world. If you find this channel valuable, please share, follow, and turn on notifications.

See you tomorrow.