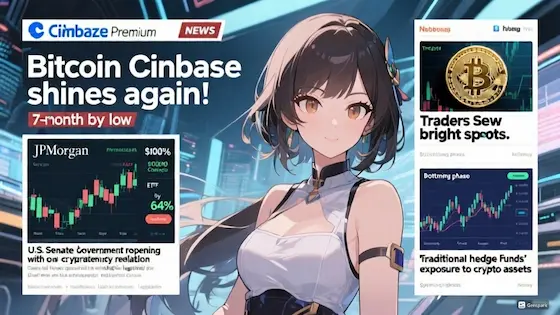

Bitcoin shines again! Coinbase Premium hits 7-month low, but traders see bright spots!

JPMorgan increases Bitcoin ETF holdings by 64% in latest filing!

The U.S. Senate is considering a bill to reopen the government, but the fate of cryptocurrency-related legislation remains unclear!

Bitcoin may be entering a “bottoming phase” as it fluctuates around the $100,000 mark!

A survey also found that the majority of traditional hedge funds have their first exposure to crypto assets!

Let’s analyze global economic and cryptocurrency news and consider economic trends together! This Saturday, November 8th, we’ll discuss today’s cryptocurrency news and on-chain market conditions. Let’s take a look at 24-hour data headlines from the cryptocurrency market.

We start with the topic, “Coinbase Premium hits 7-month low, but traders remain hopeful.”

Coinbase Premium is an indicator that shows the difference between the Bitcoin price on Coinbase, one of the world’s largest cryptocurrency exchanges, and other markets. While a decline in this figure typically signals bearish market sentiment, many traders view this as a buying opportunity, despite the lowest level in seven months. Bitcoin has rebounded strongly from similar situations in the past, leading some market participants to view this as a sign of a bottoming out.

Next, JPMorgan’s latest SEC filing revealed that it increased its Bitcoin ETF holdings by 64%, suggesting that major financial institutions remain bullish on the Bitcoin market. ETFs (exchange-traded funds) are popular with both institutional and retail investors, contributing to market liquidity and confidence. JPMorgan’s increase supports expectations of substantial capital inflows into the cryptocurrency market.

Meanwhile, on the political front, the U.S. Senate is currently considering a bill to reopen the government to avoid a government shutdown, but cryptocurrency-related bills remain uncertain. While the uncertain regulatory environment poses a risk to the market, some observers are paying close attention, believing that clearer rules may be developed in the future.

As Bitcoin’s price repeatedly bounces around the $100,000 mark, some are beginning to view it as having hit bottom. While the price has fluctuated significantly over the past few weeks, many analysts view the stabilization within this range as a positive sign.

Another interesting finding is that the majority of traditional hedge funds are now exposed to cryptocurrencies in some form for the first time. This is evidence of growing interest and acceptance of cryptocurrencies across the financial community.

So, what psychological and economic implications lie behind this series of developments?

First, market participants are increasingly expecting a bottom for Bitcoin. Despite the decline in the Coinbase Premium, buying interest remains strong, reflecting a belief that “now is the time for undervaluation.”

Second, the increase in ETF holdings by major financial institution JPMorgan signals “full-scale institutional entry,” which will lead to increased market confidence and liquidity. This trend is seen as an important factor in long-term price stability.

Third, while uncertainty remains on the political and regulatory fronts, there is also a strong expectation for the establishment of clear rules, and the market as a whole is cautiously positive.

That’s all for today’s news highlights. Our channel provides in-depth, specialized features focusing on valuable news in the cryptocurrency world. If you find this channel valuable, please share, follow, and turn on notifications.

See you tomorrow.