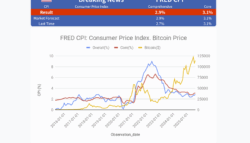

Bitcoin climbs to new heights amid hopes for Federal Reserve easing

In a thrilling turn for the crypto market, Bitcoin surged past $116,000, sparking excitement among investors eager for a potential Federal Reserve rate cut. This extraordinary rally reflects growing optimism that the Fed might ease monetary policy to support economic growth, a move that typically fuels appetite for risk assets like cryptocurrencies. Alongside Bitcoin’s impressive leap, Ether also gained traction, reinforcing the broader bullish sentiment sweeping through digital currencies.

Fed rate cut speculation drives crypto optimism

The anticipation of a Federal Reserve interest rate reduction has injected fresh momentum into the crypto space. Lower rates generally reduce borrowing costs and encourage investment in higher-yielding assets, making cryptocurrencies more attractive. Traders and investors are interpreting recent economic signals as signs that the Fed could pivot to a more accommodative stance, igniting a surge in demand for Bitcoin and Ether. This dynamic highlights the interconnectedness of traditional monetary policy and the burgeoning digital asset market, where shifts in the former can dramatically sway the latter. As the crypto community watches closely, the prospect of rate cuts could sustain this rally, marking a pivotal moment in the ongoing evolution of cryptocurrency’s role in the global financial landscape.