Regulatory Capture or Influence? Deciphering Crypto’s Relationship with Washington

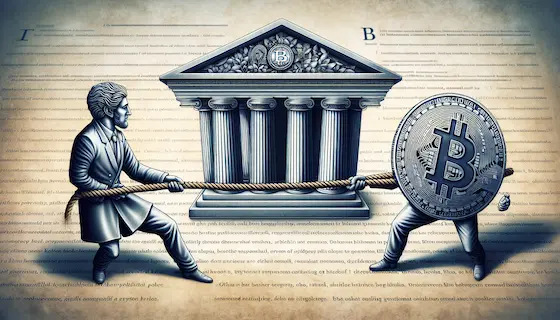

The crypto industry’s relationship with Washington is complex, often described as a battle between innovation and regulation. But a deeper look reveals a more nuanced dynamic, questioning whether crypto is a victim of regulatory capture, or if it’s wielding undue influence itself. Regulatory capture, where an industry exerts significant control over its regulators, leading to policies that benefit the industry at the expense of the public, is a concern across various sectors. But in the rapidly evolving world of crypto, determining who is capturing whom is a challenging task.

Arguments for Crypto as a Victim of Capture

Proponents of the capture theory argue that traditional financial institutions, threatened by crypto’s disruptive potential, are leveraging their long-standing relationships with regulators to stifle the industry’s growth. They point to the slow pace of regulatory clarity, the seemingly hostile stance of some agencies, and the focus on enforcement actions over fostering innovation as evidence of this capture. Furthermore, the revolving door between government agencies and established financial firms raises concerns about potential biases and conflicts of interest. Critics argue that regulations are being crafted to protect the existing financial system, hindering crypto’s ability to compete fairly. The lack of a comprehensive regulatory framework, they claim, creates uncertainty and discourages investment, ultimately benefiting incumbents.

The Counter-Narrative: Crypto’s Growing Influence

However, the narrative of crypto as a victim is increasingly challenged by its growing political clout. The industry has invested heavily in lobbying efforts, hiring former regulators and policymakers, and forming political action committees. This influx of money and influence has given crypto a voice in Washington, allowing it to shape the debate and push for favorable regulations. Some argue that this level of engagement goes beyond simply advocating for fair treatment and borders on undue influence. The ability of certain crypto firms to secure meetings with high-ranking officials and influence policy discussions raises questions about whether the playing field is truly level.

The Complexity of Defining “Capture” in a Nascent Industry

The difficulty in definitively labeling crypto as captured or capturing lies in the industry’s nascent nature. Regulations are still being developed, and the long-term impact of crypto on the financial system is yet to be fully understood. This creates a dynamic environment where both the industry and regulators are learning and adapting. It is possible that the current state of affairs is not deliberate capture by either side, but rather a messy process of negotiation and compromise in a rapidly evolving landscape.

The Need for Transparency and Balanced Regulation

Regardless of who holds the upper hand, the need for transparency and balanced regulation is paramount. The public interest must be prioritized, ensuring that regulations protect consumers and maintain financial stability while fostering innovation. Clearer definitions of digital assets, consistent regulatory frameworks across agencies, and robust oversight mechanisms are crucial for building trust and fostering responsible growth within the crypto ecosystem. This requires open dialogue and collaboration between regulators, industry players, and consumer advocates. Only through a balanced approach can we harness the potential of crypto while mitigating its risks.